For all the shopaholics, ready to take your shopping game to the next level? Well, have no fear because buy now, pay later (BNPL) services are here, and they have been recently taking the e-commerce world by storm, and for a good reason. But what exactly is BNPL, and how does it work? And does it live up to the hype?

In this guide, we'll break down the ins and outs of BNPL and how you can use it to your advantage, so you can decide for yourself if this is a payment method that works for you. So if you're looking for a way to transform your online shopping experience, what a better way to do so than diving into the world of cashew’s BNPL?

What is shop now, pay later?

Shop now, pay later is a payment method that allows you to make purchases without having to pay the full amount upfront. Instead, you can spread out the cost of a purchase over 3, 6, or 12 installments, typically over a few weeks or months, and with no interest or low-interest rates, which makes it an attractive alternative to other payment options.

It’s an excellent alternative for those who want to make larger purchases but don't have the budget to cover it all at once; this means you can finally snag those high-ticket items you've been eyeing without breaking the bank!

The use of this payment method has increased significantly over the years, going from being used every year by only a small percentage of the population to be used globally by millions of people in nearly every type of transaction, gaining popularity across different categories, including fashion, entertainment, travel, and more.

How does this service work?

It's simple. We provide you with two ways to pay at cashew. Let us break it to you in a few steps

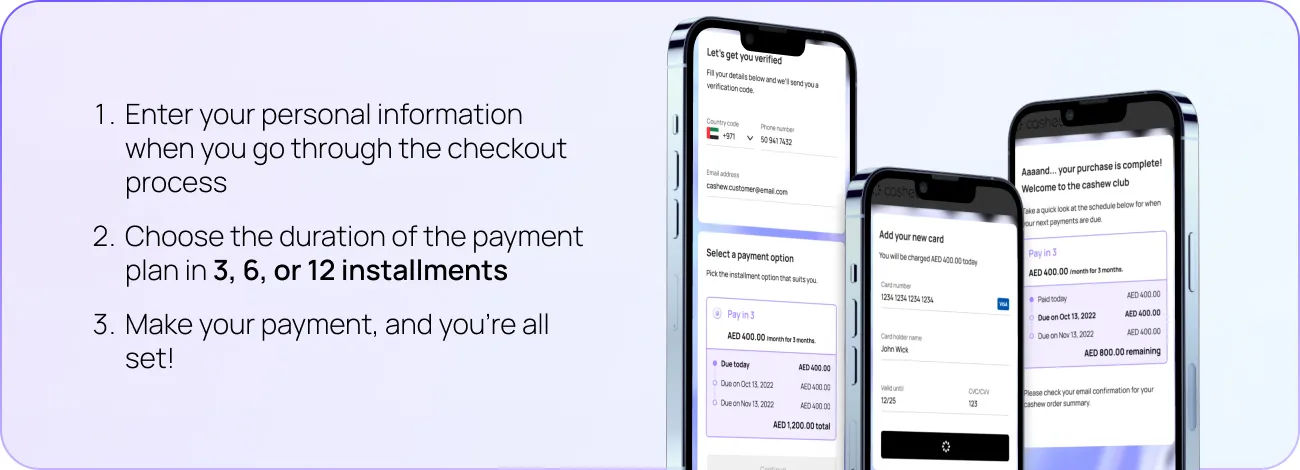

If you’re shopping online:

- Enter your payment information when you go through the checkout process on one of our featured stores' or merchant partners' websites.

- Select Pay Later as the payment method.

- Choose the duration of the payment plan that is right for you. (In 3, 6, or 12 installments)

- Make your payment, and you're all set!

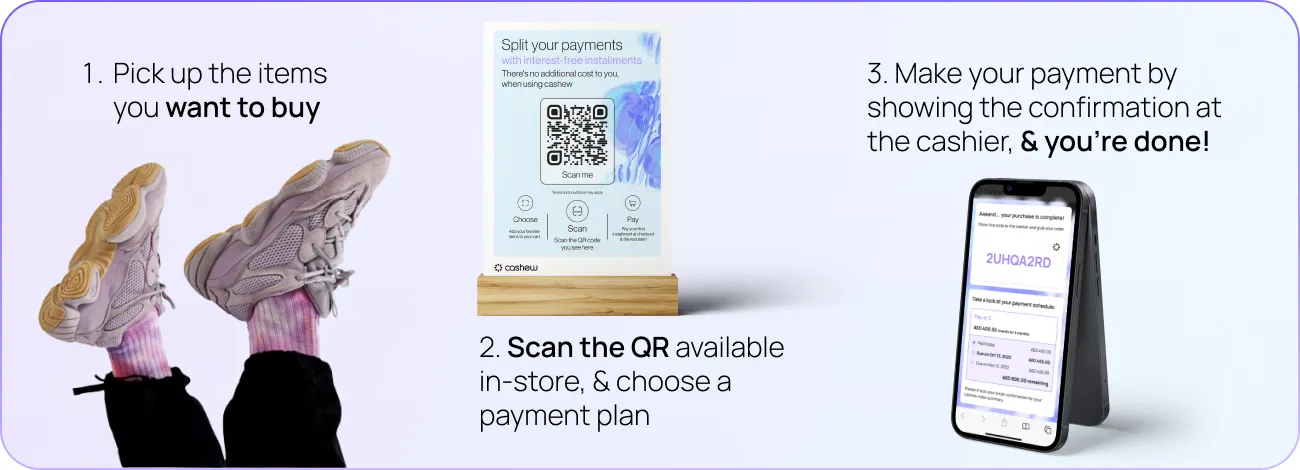

If you’re shopping in-store:

- Pick up the items you want to buy

- Scan the shop now, pay later barcode in-store, and then you’ll be able to choose from one of our payment plan options

- Make your payment, and you’re done!

Can BNPL affect your credit card score?

Using BNPL services can have an impact on your credit score, but it ultimately comes down to how responsible you are with your payments. If you miss a payment or are late on a payment, it could negatively affect your score. On the flip side, making your payments on time can actually improve your score. So, it's important to be mindful of your payments and due dates.

What are the pros and cons of BNPL?

When it comes down to using shop now, pay later as a payment method, it is important to consider the pros and cons; that’s why we've outlined some of the key advantages and disadvantages so that you can make an informed decision on whether it’s right for you.

The pros of shop now, pay later

Here are just a few of the many benefits of using BNPL:

- Flexibility: You can enjoy more flexibility when making your purchases as using BNPL gives you greater control over your budget and helps to manage the financial commitments you take on. With cashew, you can choose to spread the cost over multiple installment duration plans from 3, 6, and up to 12 interest-free installments, depending on your needs and preferences.

- Budget-friendly payments: This payment method allows you to spread the cost of your purchase over a number of manageable installments, so you can shop to your heart's content without worrying about the financial strain of a one-time payment.

- No-interest or low-interest rates: Yes, you read that right! You can now say goodbye to hefty interest charges as many BNPL services offer no interest or low-interest rates, making your purchases more cost-effective and helping you keep those finances in check.

- Easy and fast approval: Applying for a BNPL payment plan is a breeze! You can get approved in a matter of minutes, all you need to do is pass a simple eligibility check, and the best part is that you don't need to undergo a credit check or provide proof of income.

The cons of shop now, pay later

While BNPL has its benefits, it's not without its drawbacks. Here are a few potential cons to keep in mind:

- Temptation to overspend: Shop Now Pay Later can make it all too easy to overspend. So if you’re not careful with your budget, it can be tempting to buy items that you may not be able to truly afford.

- Late fees and interest charges: While many buy now pay later services offer no interest or low-interest rates, if you miss a payment, you may be subject to late fees or higher interest charges.

- Limited options: Not all retailers offer BNPL as a payment option. Furthermore, some retailers that do offer BNPL may only offer it on certain items.

But, as long as you use Shop Now, Pay Later responsibly and understand the terms and conditions of your plan, you can enjoy the benefits without having to worry about the drawbacks.

So shop smart, stay on top of your payments, and enjoy the thrill of shopping now with cashew. For a better experience, download the cashew app for IOS and Android. And if you still have any questions or concerns regarding your BNPL account, then we highly recommend checking out our customer support FAQs or contacting our friendly customer service team.